Environmental, social, and governance (ESG) considerations have become increasingly important for investors and companies in recent years. As a result, ESG ratings have emerged as a way to evaluate a company’s performance in these areas.

But what exactly are ESG ratings, and what do they mean? This blog outlines everything you need to know about ESG ratings and whether to add company stock to your portfolio.

ESG Ratings Defined

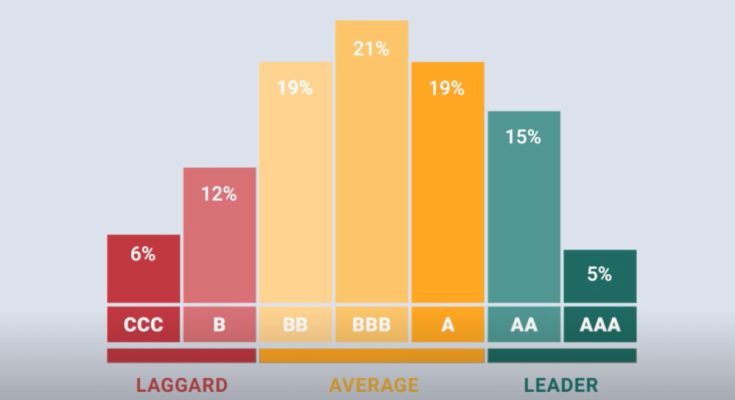

ESG ratings are a set of metrics used to evaluate a company’s performance on environmental, social, and governance issues. Typically third-party providers who collect data from companies supply these ratings and then analyze that data to create a score or rating.

ESG ratings help investors and other stakeholders understand how well a company manages its environmental and social risks and how effective its governance policies and practices are. They can also be used to compare the performance of different companies within an industry or sector or to track the progress of a single company over time.

The Three Components of ESG Ratings

As the name suggests, ESG ratings comprise three main components: environmental, social, and governance.

- Environmental: This component of ESG ratings evaluates a company’s environmental impact, including its use of natural resources, energy efficiency, greenhouse gas emissions, and waste management practices.

- Social: The social component of ESG ratings looks at a company’s impact on society, including labor practices, human rights policies, community engagement, and product safety.

- Governance: The governance component of ESG ratings evaluates a company’s management structure and policies, including its board composition, executive compensation practices, and transparency and accountability measures.

ESG Ratings and Investing

ESG ratings have become essential for investors looking to incorporate sustainability and social responsibility into their investment strategies.

Using ESG ratings, investors can evaluate different companies’ environmental and social risks and opportunities and make investment decisions that align with their values.

However, as with any rating system, ESG ratings have their limitations. For example, the ratings are only as good as the data, and some companies may need to provide accurate or complete information. Different ESG rating providers may use different methodologies, leading to variations in scores and ratings.

Can You Trust ESG Scores?

As ESG ratings have grown, so too have questions about their reliability and accuracy. Some critics argue that ESG ratings are too subjective and that no standard methodology for measuring ESG performance exists.

However, many ESG rating providers have taken steps to address these concerns. For example, some providers now use artificial intelligence and machine learning algorithms to analyze data and create ratings, which can reduce the risk of bias or subjectivity. Many providers now offer detailed explanations of their methodologies, allowing investors to customize their ratings based on their priorities and values.

Don’t Hesitate: Incorporate ESG Ratings into Your Investment Strategy Today

ESG ratings are essential for investors and other stakeholders to evaluate a company’s performance on environmental, social, and governance issues. While ESG ratings have limitations, they can provide valuable insights into a company’s sustainability and social responsibility practices. As the use of ESG ratings continues to grow, it will be necessary for investors and companies alike to understand how these ratings work and drive positive change.