Introduction

In the ever-evolving landscape of financial services, L&T Finance stands tall as a trusted name. With a commitment to delivering loans and financial solutions to over half a million people across India, L&T Finance has earned its reputation for reliability and excellence. Their latest offering, the MIflow web app, is set to elevate the financial experience for both customers and staff alike.

In this comprehensive guide, we’ll delve into the miflow. ltferp. com, exploring its features, functions, and how it empowers users in managing their loans and finances seamlessly. So, fasten your seatbelts as we take you on a journey through the world of MIflow and the invaluable services offered by L&T Finance.

What is the MIflow Portal?

MIflow, also known as the Microfinance Collection Repository Portal, is L&T Finance’s digital solution designed to enhance the microfinance experience for customers and streamline collection processes. It represents a significant leap towards making financial management more accessible, transparent, and efficient.

L&T Finance

L&T Finance has carved a niche for itself in the financial market by consistently providing loans and financial services to a vast customer base. Among their range of services, microfinance holds a prominent place. Microfinance, often referred to as short-term finance, is a lifeline for many individuals and businesses, offering flexible loan options spanning from 3 months to 2 years.

Understanding the MERC Portal

The MIflow portal, often colloquially referred to as the MERC portal, serves as a centralized hub for all financial-related transactions and information. Given the high volume of customers and the extensive loan portfolio managed by L&T Finance, a dedicated portal became essential to streamline operations and provide a seamless experience to customers.

Every financial interaction with L&T Finance revolves around the collection process. The MERC portal acts as the backbone for managing customer details, loan amounts, and installment schedules, making it a valuable tool for both customers and the dedicated staff representing L&T Finance.

Key Features and Services Offered by MIflow

- miflow ssc login: Easily access your MIflow account with a simple login process.

- miflow access management: Effortlessly manage and update your account information.

- ltfs login: Access L&T Finance services through the portal.

- ltferp access management system: Efficiently manage and monitor your financial transactions.

- ssc login l&t: Streamline your interactions with L&T Finance.

- ltfs microfinance miflow: Seamlessly integrate microfinance services with the MIflow portal.

- ltferp login: Securely log in to the portal for uninterrupted service.

- l&t collection app: Access the collection app for added convenience.

Accessing MIflow

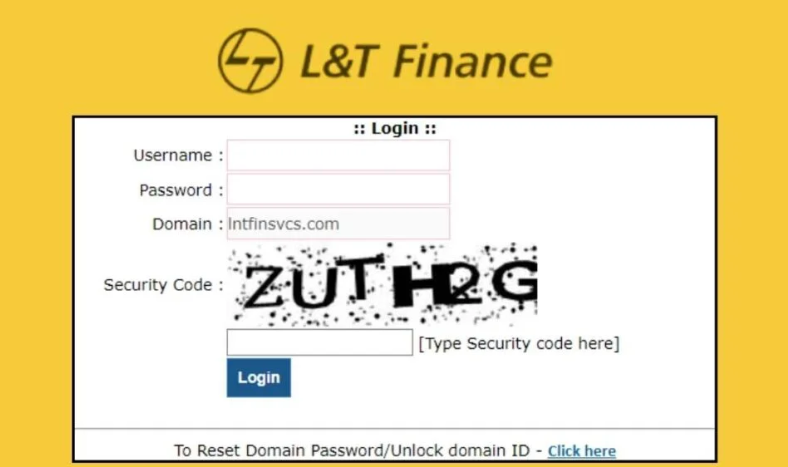

Now that you understand the significance of MIflow and its integration with L&T Finance, let’s walk you through the simple process of accessing your MIflow account.

- Visit the Official Website: Start by visiting the official MIflow website. Alternatively, you can click on the provided link for quick access.

- Click on the Login Button: On the website, locate and click on the ‘Login’ button.

- Enter Your Login Credentials: You will be prompted to enter your official login ID, provided you are eligible to use the portal. Following that, input your MIflow account password.

- Select Your Domain: Next, select your domain name from the options available.

- Click on the Login Button Again: Confirm your details and finalize the login process by clicking on the ‘Login’ button.

Congratulations! You have successfully logged in to the MIflow portal, where a world of financial management awaits you.

L&T Microfinance

L&T Finance is not just a financial institution; it’s a catalyst for empowering women in the world of business. Through microloans tailored for women entrepreneurs, L&T Finance has made significant strides in promoting economic independence and growth among women.

Key Details of L&T Microloans

- Processing Fees: A nominal processing fee of 1% is charged.

- Collateral-Free: These microloans require no collateral, making them accessible and low-risk.

- Flexible Repayment: Borrowers can create a monthly repayment schedule that suits their financial situation.

- Age Criteria: Applicants must be between 20 and 60 years of age to be eligible.

- Exclusively for Women: L&T Microloans are designed exclusively for women entrepreneurs.

- Maximum Loan Amount: Borrowers can avail a maximum loan amount of INR 45,000.

- Tenure: The maximum tenure for these microloans is 24 months.

Your Financial Companion

MIflow, the brainchild of L&T Finance, has emerged as a trusted financial companion for thousands of customers across India. Its user-friendly interface and robust features make it an indispensable tool for individuals and businesses alike. Let’s explore the myriad benefits it brings to the table.

A Unified Financial Ecosystem

MIflow seamlessly integrates various financial services under one virtual roof. Whether you are seeking short-term loans, microfinance options, or need assistance with loan documentation, MIflow simplifies it all. Gone are the days of juggling multiple platforms; MIflow provides a unified ecosystem for all your financial needs.

Real-Time Loan Management

One of the standout features of MIflow is its real-time loan management capabilities. Customers can effortlessly monitor their loan status, outstanding balances, and repayment schedules. This transparency empowers borrowers with complete control over their finances, ensuring they never miss a payment.

Hassle-Free Loan Applications

MIflow eliminates the tedious paperwork traditionally associated with loan applications. With a few clicks, users can apply for loans, upload necessary documentation, and track the progress of their applications. The portal streamlines the entire loan application process, making it quicker and more convenient.

Competitive Interest Rates

L&T Finance understands the importance of competitive interest rates for borrowers. MIflow provides users with easy access to information on interest rates for various loan products. This transparency allows borrowers to make informed decisions and choose loan options that suit their financial goals.

MIflow User Guide

For those new to MIflow, navigating the portal may seem daunting at first. However, a comprehensive user guide is available to assist users in making the most of its features. Whether you are a first-time borrower or an experienced user, the guide offers valuable insights and step-by-step instructions to ensure a seamless experience.

Customer Support

In the world of finance, having access to reliable customer support is crucial. L&T Finance recognizes this and provides dedicated customer support services for MIflow users. Whether you have inquiries about loan eligibility, repayment options, or simply need assistance with portal navigation, the support team is just a call or email away.

What Sets MIflow Apart?

While there are numerous financial portals and apps available, MIflow stands out for several reasons:

- Trusted Legacy: MIflow is a product of L&T Finance, a well-established name in the financial sector. This legacy of trust and reliability extends to the portal, assuring users of its credibility.

- User-Centric Design: MIflow’s user interface is designed with the end-user in mind. Its intuitive layout and easy navigation ensure that users of all tech-savviness levels can make the most of its features.

- Transparency: MIflow’s commitment to transparency sets it apart. Users can access a wealth of information about loan products, interest rates, and their own financial details, empowering them to make informed decisions.

- Empowering Women: L&T Finance’s microloans for women entrepreneurs are a testament to their commitment to financial inclusion. MIflow plays a pivotal role in extending these services to women, enabling them to embark on entrepreneurial journeys with confidence.

Frequently Asked Questions (FAQs)

What is the official website of MI-FLOW?

The official website of MI-FLOW is https://miflow.ltferp.com/mficollections/.

What is the full form of Merc?

The full form of Merc is a microfinance collection repository.

Can I sign in for a new account on MI-FLOW?

No, you cannot sign in for a new account on MIflow.

Who is the parent company for the MIflow portal?

The parent company of the MIflow portal is L&T Finance Limited.

For More Visit: Strategies for Streamlining Data Storage to Foster Easy Data Retrieval

Conclusion

In the dynamic world of finance, having easy access to your financial information and services is paramount. MIflow by L&T Finance is not just a portal; it’s a gateway to financial ease, transparency, and empowerment. Whether you’re a microfinance customer or a member of L&T Finance’s dedicated staff, MIflow. ltferp. com is designed to make your financial journey seamless and convenient.

So, why wait? Dive into the world of MIflow and discover how L&T Finance is transforming the way you manage your finances. Whether it’s short-term loans, microfinance services, or the convenience of a user-friendly portal, L&T Finance has you covered. Unlock the power of MIflow today and embark on your journey to financial freedom!

Please note that the information provided here is based on our knowledge as of January 2022, and there may have been updates or changes since that time. For the most current information on MIflow and L&T Finance’s services, please visit their official website.